Solar Investment Tax Credit has been providing tax reduction incentives since 2006. When the Inflation Reduction Act of 2022 was signed into law by the federal government on August 16, 2022, adopting residential solar energy became an even more tempting task to do.

The Residential Clean Energy Credit, also known as the Solar Investment Tax Credit, has been increased, expanded, and extended and is the most significant among various incentives for environmentally aware consumers and businesses.

The ITC effectively increases the credit from 26% to 30%, which you can apply to your income tax burden. It will decrease again in 2032 rather than the next year as initially planned. The tax benefit was also retroactive for solar energy systems installed during the 2022 tax year. Here are some things you should know about the ITC and how to use it to your advantage.

For those looking to put solar panels on their homes, California has historically been one of the most significant places in the region. The top three utility companies’ electricity is very costly, and the price keeps rising yearly. Additionally, there are instances each year where thousands of people are affected by public safety power shutoffs in numerous parts of California due to a faulty grid.

These issues can be resolved with commercial solar panels and a battery, which can help you avoid blackouts and save thousands on your yearly electric expenses.

You might wonder whether solar energy can benefit your home or business since over 10% of Californian homes and companies have installed solar panels. As long as your home’s roof is adequate and supports solar panels, you will be able to install them.

But taking early action can be in your best interests. California is updating its solar regulations through a procedure known as NEM 3.0. The modifications may lessen the savings on bills that currently make solar power an excellent financial decision for many homeowners.

Now that NEM 3.0 amendments have been finalized, they will apply to anyone who signs a contract for solar panels on or after April 13, 2023.

Therefore, there is still time to locate a solar company and register under the applicable rules. California also provides solar incentives if you attach a battery to a solar project. Additionally, the federal government provides a sizable tax credit on the price of solar and batteries.

Solar Tax Credit: What is it?

The Solar Tax Credit lowers your income tax in exchange for switching to solar power. The ITC enables business and residential property owners who bought and installed solar photovoltaic energy generation systems in 2022 or will do so before 2033 to claim a federal tax credit equal to 30% of the total cost of the commercial solar installation, components, and related costs during the year of installation.

A tax credit is a dollar-for-dollar decrease in the income tax you would have had to pay if the credit had not been available. If the solar PV system costs $20,000 and you are eligible for the ITC at 30%, your annual income tax obligation will be reduced by $6,000, bringing the system’s actual cost down to $14,000.

According to the latest version of the legislation, you can carry over the difference to the subsequent year if the amount of tax you owe for the year you become eligible is lower than the credit amount. In 2033 and 2034, the ITC will decrease to 26% and 22%. If there isn’t another extension, the credit will be terminated at the end of that year.

The tax credit is a credit, not a refund. The IRS enables you to deduct 26% of the cost of your solar system from the taxes you owe, and it is different from the federal government will send you a check in the amount of the credit.

To be eligible for the entire tax credit, you should purchase a residential solar system by the end of the year. Before the end of the year, the system must be put in service, which means it must be installed and operational. It can occasionally take several weeks to sign a contract and install a system.

How Do You Claim Solar Tax Credit?

If you are eligible for the Solar Tax Credit, you must complete Form 5695 and submit it along with your federal tax return for the tax period in which the PV system was initially built and brought online.

Who is Eligible for Solar Tax Credit?

If you meet the conditions mentioned above, you can be qualified to claim the ITC on your federal tax return. You can speak with your tax accountant to confirm your eligibility and obtain information on exceptions. The following are included in the eligibility criteria:

- The PV system is newly installed, or it has just started working.

- You either purchased the system or used the financing to pay for the components and installation.

- The system is not leased to you, and you are not charged for the energy it produces.

- You are requesting credit based on the price of the PC system, its parts, installation costs, and other expenses. This tax credit does not apply to items or appliances that use the generated energy.

Expenses Covered in Solar Tax Credit

The new law involves energy storage components such as standalone devices that have the capacity of three-kilowatt hours in the list of expenses eligible for the tax credit.

The cost of the solar panels and their parts, licenses, sales tax, and other fees, as well as the necessary hardware, wiring, site preparation, inverter systems, and installation, are all covered.

The ITC will start to fade out in 2033, even though it will continue to exist for at least the ensuing ten years. The credit amount reduces to 26% at that point. It will be further decreased to 22% in 2034 and removed for the 2035 tax year.

When Should You Go Solar?

The new legislation is currently in force and will continue until the end of 2034. Going solar is more attractive than ever right now from almost every perspective.

So if you are thinking of jumping in and switching to solar or waiting for a better deal in the future, the answer might be more complex than it first appears. Here are several considerations to keep in mind:

- Solar technology is now more advanced, affordable, and effective than ever.

- Even with tax breaks from the federal, state, and utility companies, it typically takes a system six to ten years to pay for itself through lower energy expenses.

- The tax credit lowers your overall tax liability. It doesn’t apply to purchases and installation right away. You still have to pay for the system’s upfront cost.

- Many states provide some net metering, which essentially rewards you for producing more energy with a PV system than you consume. These initiatives are up for debate in some places and might only survive for a while.

- Other factors of the law provide incentives to the solar industry and makers of goods related to it. Over the coming years, how these incentives will generally affect prices is still being determined.

- There are alternatives to building your own solar energy system, such as taking a stake in an off-site solar project, which can qualify for tax credits.

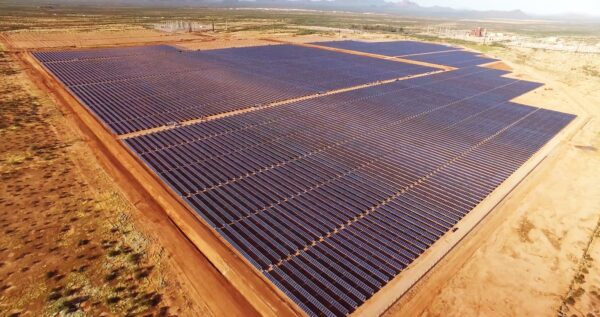

Coldwell Solar Offers Solar Solutions to California Businesses

There are many benefits of solar energy for your business, including the potential solar tax credits that are available. Interested in started your commercial solar project? Contact Coldwell Solar for more information on solar incentives in California and to start your solar installation.